Preferred Dividends: Everything You Need to Know

Then factor in any dividends that would have been paid with each additional common share over this period. Finally, assume that these shares were converted or issued and calculate eps accordingly. Like bonds, preferred stocks are rated by the major credit rating companies, such as Standard & Poor’s and Moody’s.

How comfortable are you with investing?

It represents their share of the company’s profits and is an incentive for them to hold onto the stock for the long term. The board may raise, reduce, or eliminate its dividend based on the recent success bigger, better college tax credit of the business and depending on what other priorities it sees for the money. Preferred share dividends are normally fixed, so the shares don’t benefit from the growth of the issuing corporation.

Premium Investing Services

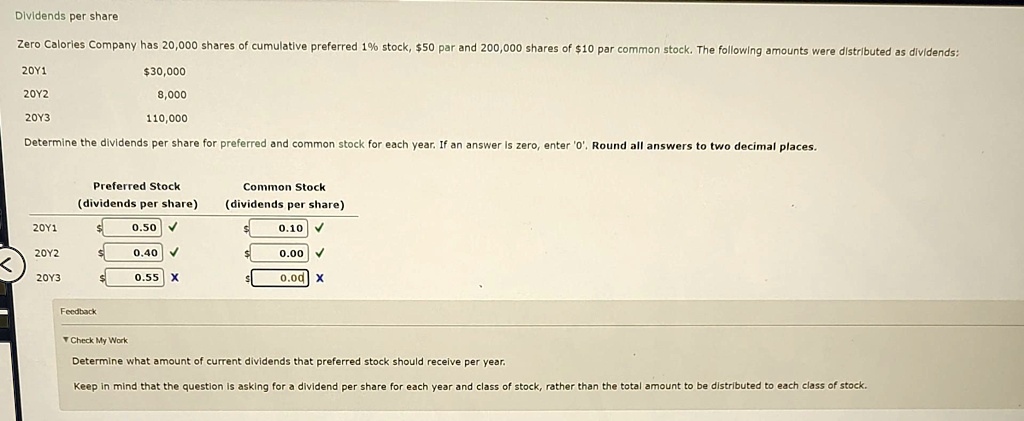

The accumulation of unpaid cumulative dividends can raise the share price of the preferred stock above its par value. The price reflects that cumulative preferred stocks’ shareholders must eventually receive all accrued dividends before common shareholders are paid dividends. The conversion ratio determines the number of common shares received per convertible preferred share, providing holders with the flexibility to capitalize on the upside potential of the underlying stock. An example To illustrate this, let’s say that you own the preferred stock of a company that has run into financial trouble, and has been forced to suspend its dividend payments for the past three quarters.

Cumulative Dividend Yield

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

- Convertible preferred stock has lower preferred dividends, as the investor receives the additional of converting the preferred stock to common stock.

- This says that, if any dividend payments have been skipped, they must be paid out to preferred shareholders before common shareholders are paid any current dividends.

- In some cases, a company may pay the shareholders future dividends at the time it buys back the stock.

- In addition to the fixed dividend, participating preferred shareholders may also receive a portion of the remaining profits after common shareholders are paid.

- If the company fails to pay this dividend in one year, that outstanding 5% dividend will accumulate.

Understanding Preferred Dividends

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Investors must understand the distinctions among the types of dividends so that they can make informed decisions regarding their investment portfolios.

Do you already work with a financial advisor?

If it is assumed that convertible preferred stock will be converted within the next 10 years, the number of issuable common shares would decrease by the appropriate fraction. Participating preferred dividends contribute to the overall appeal of preferred stock, making it a compelling choice for investors seeking both stability and the possibility of enhanced returns. The fixed rate of preferred dividends establishes a baseline, while the participation feature allows for upside potential when the company performs well. This long-term suspension of preferred dividends can serve as a concerning signal to shareholders, raising concerns about the company’s overall financial health and future prospects.

The total Accumulated Dividend is 180; in 2020, if the company makes a profit, it will have to clear the total accumulation of 180 + 2020 preferred dividend, then common stockholders can be paid. In this situation the company establishes the dividend amount and volume for shareholders and guarantees its distribution to them. If for any reason the company cannot make the dividend payment, the outstanding dividends will accumulate over time. For newly-issued convertible preferred stock, any adjustment to the numerator is limited to the number of dividends actually declared (or accumulated).

If you want to determine how much your dividend will be on a quarterly basis (assuming your preferred stock pays quarterly), simply divide this result by four. Company X Inc. has 3 million outstanding 5% preferred shares as of December 31st, 2016. Once you know how to calculate the preferred dividend per share, you need to multiply the number of shares with the preferred dividend per share. Plus, if the firm gets bankrupt any day, you will be given preference over equity shareholders. If the company becomes bankrupt before equity shareholders are paid a buck, you will get the amounts due to you.