What are Retained Earnings? Guide, Formula, and Examples

Content

In this case, the company would need to take action to improve its financial position. Retained earnings represent a critical component of a company’s overall financial health, as they indicate the profits and losses the company has retained. Retained earnings are the portion of a company’s net income that is not paid out as dividends.

Most companies with a healthy retained earnings balance will try to strike the right combination of making shareholders happy while also financing business growth. By subtracting the dividends paid from the net income, you can see how much profit the company has reinvested in itself. By looking at these items, you can understand a company’s performance over time and dividend policy.

Another example of retained earnings calculation

Retained earnings are the residual net profits after distributing dividends to the stockholders. This is the net profit or net loss figure of the current accounting period, for which retained earnings amount is to be calculated. A net profit would lead to an increase in retained earnings, whereas a net loss would reduce the retained earnings.

- You can derive it by taking retained earnings, adding in dividends and subtracting profits.

- The main difference between retained earnings and profits is that retained earnings subtract dividend payments from a company’s profit, whereas profits do not.

- Yes, retained earnings can be negative, however counterintuitive it might sound.

- There can be cases where a company may have a negative retained earnings balance.

- Doing so will ensure that your company uses its earnings efficiently and maintains the right balance between growth and profitability.

So, if a company pays out $1,000 in dividends, its retained earnings will decrease by that amount. Accountants must accurately calculate and track retained earnings because it provides insight into a company’s financial performance over time. Accurate calculations can help the company make informed business decisions and ensure that profits get reinvested to benefit the company. Retained earnings means the amount of net income left after the company has distributed dividends to its common shareholders. The retained earnings can act as a metric for analyzing a company’s financial health because it is the money leftover after all the direct and indirect costs are deducted. Retained earnings represent the portion of net profit on a company’s income statement that is not paid out as dividends.

Factors that can influence a company’s retained earnings

To find your shareholders’ equity (or owner’s equity) balance, subtract the total amount of dividends paid out from the beginning equity balance. Thus, you’ll have a crystal-clear picture of how much money your company has kept within that specific period. Another factor influencing retained earnings is the distribution of dividends to shareholders. When a company pays dividends, its retained earnings are reduced by the dividend payout amount.

If your business recorded a net profit of, say, $50,000 for 2021, add it to your beginning retained earnings. The company may use the retained earnings to fund an expansion of its operations. The funds may go into building a new plant, upgrading the current infrastructure, or hiring more staff to support the expansion. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent.

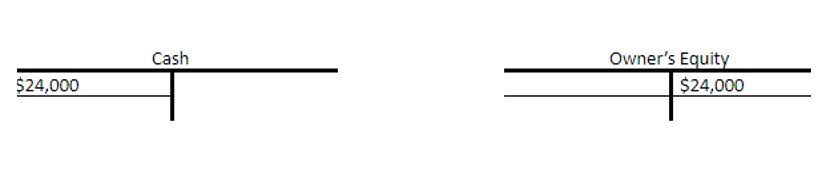

Step 2: State the Balance From the Prior Year

Negative retained earnings mean a negative balance of retained earnings as appearing on the balance sheet under stockholder’s equity. A business entity can have a negative retained earnings balance if it has been incurring net losses or distributing more dividends than what is there in the retained earnings account over the years. Instead, they reallocate a portion of the RE to common stock and additional paid-in capital how to solve for retained earnings accounts. This allocation does not impact the overall size of the company’s balance sheet, but it does decrease the value of stocks per share. Retained Earnings are listed on a balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate Retained Earnings, the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted.

That said, investing can also lead to profitable returns that you can use to grow your business further. While they may seem similar, it is crucial to understand that retained earnings are not the same as cash flow. Retained earnings represent the profits a business generates over time, while cash flow measures the net amount of cash/cash equivalents coming and and out over a given period of time. With this retained earnings calculator, you can easily calculate how much money a company has left to reinvest into its business. Retained earnings is useful when analyzing the financial health of the company.