How to Calculate and Understand Your Companys Debt-to-Equity Ratio

Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another. Gearing ratios constitute a broad category of financial ratios, of which the D/E ratio is the best known. Finally, if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1.

Cash Ratio

- Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income.

- Aside from that, they need to allocate capital expenditures for upgrades, maintenance, and expansion of service areas.

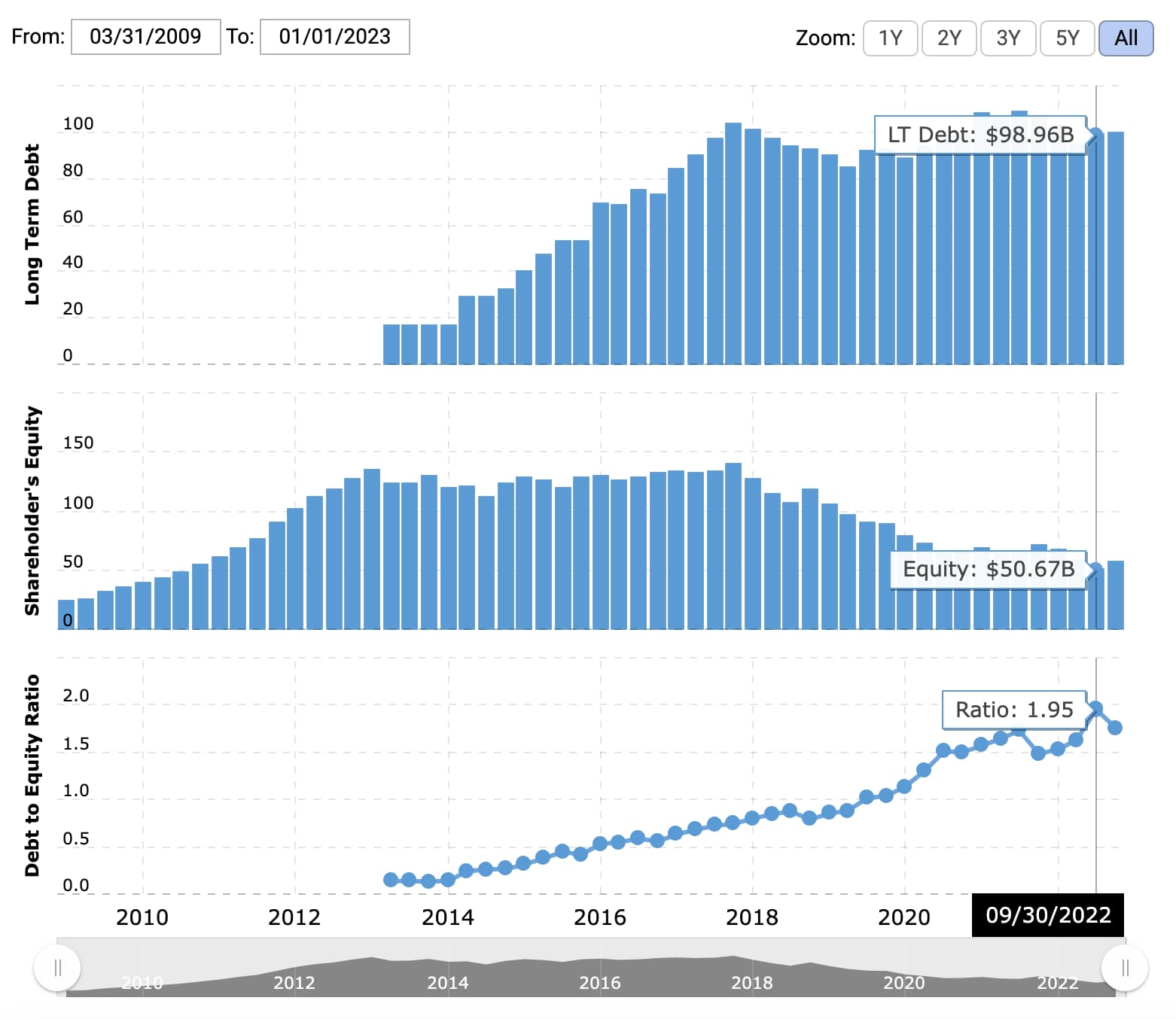

- The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account.

- If a company has a negative D/E ratio, this means that it has negative shareholder equity.

But if a company has grown increasingly reliant on debt or inordinately so for its industry, potential investors will want to investigate further. The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income. In addition, debt to equity ratio can be misleading due to different accounting practices between different companies.

What is the approximate value of your cash savings and other investments?

It shows the proportion to which a company is able to finance its operations via debt rather than its own resources. It is also a long-term risk assessment of the capital structure of a company and provides insight over time into its growth strategy. Understanding the debt to equity ratio is essential for anyone dealing with finances, whether you’re an investor, a financial analyst, or a business owner. It shines a light on a company’s financial structure, revealing the balance between debt and equity. It’s not just about numbers; it’s about understanding the story behind those numbers. This number represents the residual interest in the company’s assets after deducting liabilities.

What is the debt-to-equity ratio?

Economic factors such as economic downturns and interest rates affect a company’s optimal debt-to-income ratio by industry. A company that does not make use of the leveraging potential of debt financing may be doing a disservice to the ownership and its shareholders by limiting the ability of the company to maximize profits. The cash ratio provides an estimate of the ability of a company to pay off its short-term debt.

Ask Any Financial Question

In other words, the ratio alone is not enough to assess the entire risk profile. While a useful metric, there are a few limitations of the debt-to-equity ratio. As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context.

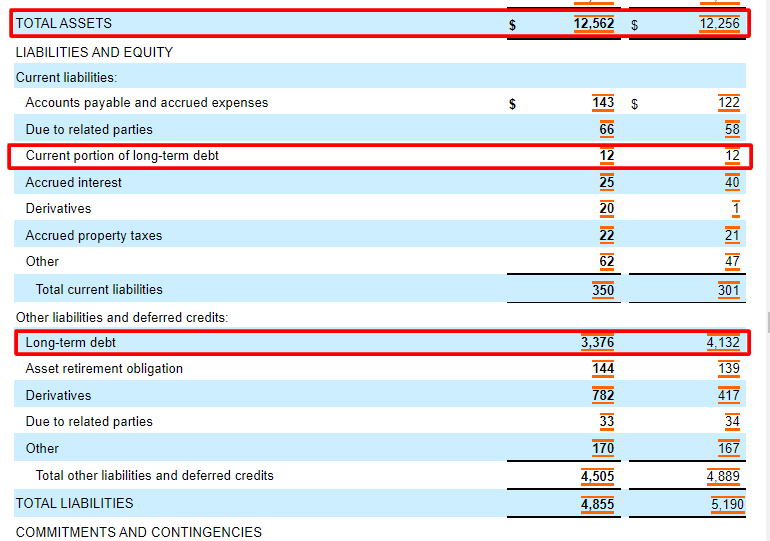

When using a real-world debt to equity ratio formula, you’ll probably be able to find figures for both total liabilities and shareholder equity on a company’s balance sheet. Publicly traded companies will usually share their balance difference between tangible and intangible assets with examples sheet along with their regular filings with the Securities and Exchange Commission (SEC). The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns.

While acceptable D/E ratios vary by industry, investors can still use this ratio to identify companies in which they want to invest. First, however, it’s essential to understand the scope of the industry to fully grasp how the debt-to-equity ratio plays a role in assessing the company’s risk. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow.

As a result, there’s little chance the company will be displaced by a competitor. The investor has not accounted for the fact that the utility company receives a consistent and durable stream of income, so is likely able to afford its debt. They may note that the company has a high D/E ratio and conclude that the risk is too high. One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company.

Over time, the cost of debt financing is usually lower than the cost of equity financing. This is because when a company takes out a loan, it only has to pay back the principal plus interest. If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each.

However, such a low debt to equity ratio also shows that Company C is not taking advantage of the benefits of financial leverage. In other industries, such as IT, which don’t require much capital, a high debt to equity ratio is a sign of great risk, and therefore, a much lower debt to equity ratio is more preferable. If a company cannot pay the interest and principal on its debts, whether as loans to a bank or in the form of bonds, it can lead to a credit event. The D/E ratio is one way to look for red flags that a company is in trouble in this respect. The optimal debt-to-equity ratio will tend to vary widely by industry, but the general consensus is that it should not be above a level of 2.0.

You can find the inputs you need for this calculation on the company’s balance sheet. In most cases, liabilities are classified as short-term, long-term, and other liabilities. For companies that aren’t growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued. For growing companies, the D/E ratio indicates how much of the company’s growth is fueled by debt, which investors can then use as a risk measurement tool.