pocket option course? It’s Easy If You Do It Smart

Compare Best Trading Platforms in the UK

A Doji is often a good opportunity to either trail your stop because a reversal is just as likely or take partial profits on your position to protect yourself from a market turn. The login page will open in a new tab. Use profiles to select personalised advertising. There are two types of margin to consider. Find him on: LinkedIn. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. With 22 years in business and thousands of satisfied clients later, Sharekhan is here for you. Traders use technical analysis indicators such as moving averages, MACD Moving Average Convergence Divergence, RSI Relative Strength Index, and stochastic oscillators to identify potential entry and exit points within the market’s minute by minute fluctuations. Public companies companies listed on a stock exchange, often have a lot of shares. As an Amazon Associate, investor. It can simplify everything for you and would save you lots of time. Please visit our UK website. Our writers have collectively placed thousands of trades over their careers. Businesses typically chew up a lot of your attention. Before you confirm that you want to copy a trader, you can adjust the overall risk settings to suit your own goals and risk tolerance. Easy and user friendly interface You won’t want to go through several manuals just to buy or sell stock. Your plan should outline your goals, trading strategies, risk management plan, and your financial targets. $65/mo$195 billed every 3 months. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. This differs markedly from traditional “buy and hold” investment strategies, as day traders rarely maintain overnight positions, closing out all trades before the market shutters. Many traders lose money, highlighting the importance of using the right tools and strategies. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. With IG DealerAndreas Vassiliou. Intraday trading, also known as day trading, is a common type of stock market trading. Then, backtest your strategy using historical data. Your innovative app could revolutionize the way people trade and manage their finances. Past performance evaluations will assist you in making better trading judgments in the future. To get out of a trade, an investor must do the reverse. It calls for a good understanding of trading and investment practices as well as constant monitoring of market fluctuations to protect against losses. Securities quoted are exemplary and not recommendatory.

15 Best AI Day Trading Bots of All Time

We would suggest extensive forward and backward testing before deploying the strategy live. Necessary cookies are required to make our website functional, to maintain security and to save certain features and cannot be deselected. 7 ratings in the App Store and Google Play respectively. Even the best risk management strategy cannot protect your capital if the risk reward ratio of your trades is not favorable. Watch out for hot tips and expert advice from newsletters and websites catering to day traders, and remember that educational seminars and classes about day trading may not be objective. You will have to open a standard brokerage account, but you do not need to deposit anything into it. Metrics, such as trading volume, provide clues as to whether a price move will continue. If the MACD is below zero, the MACD crossing below the signal line may provide the signal for a possible short www.po-broker-in.website trade. How might you have traded something like this. This is seen as a “minimalist” approach to trading but is not by any means easier than any other trading methodology. 0 Attribution License.

NSE Holidays List 2024

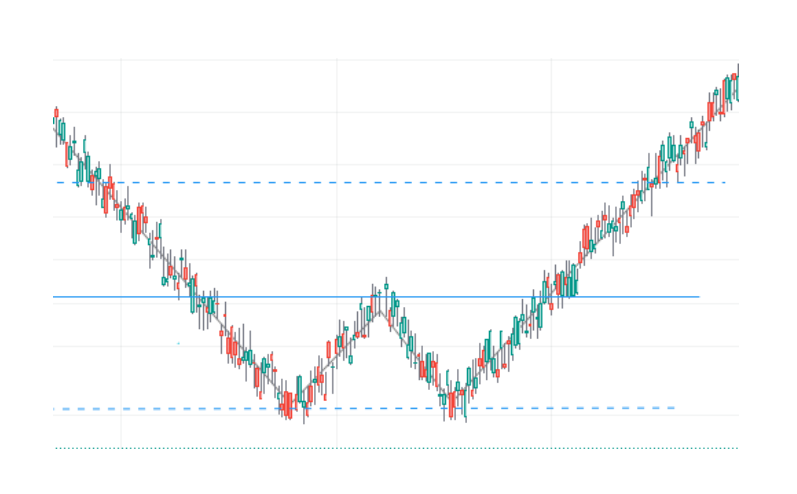

» MORE: See What Is a Stock. Given the growth in the options and derivatives markets over the past five years, this book is required reading for any serious investor or anyone in the financial service industries. The clock isn’t just a backdrop; it’s a dynamic force that shapes trading strategies, market liquidity, and profit outcomes. Thank you all for your responses and time. The first option to trade a double bottom pattern is to enter the trade as soon as the Pattern is complete and the price breaks the neckline. Get it in the Microsoft Store. Timing entry and exit points correctly can significantly impact a trader’s profitability. Underlying Closing Price. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. And also those holding fees per month which just suck away so much of your gains. It does not matter how rigorous your robustness testing procedures are, or how cautious you are. What is Options Trading. It should also include your goals and the amount of capital you’re willing to allocate to each trade. Watch out for hot tips and expert advice from newsletters and websites catering to day traders, and remember that educational seminars and classes about day trading may not be objective. NSE Pathshala is a comprehensive virtual trading platform provided by the National Stock Exchange NSE of India. 2nd October, WednesdayMathatma Gandhi Jayanti. The first and foremost thing that you should do when getting into day trading is selecting the right stock to buy. In a famous trading experiment by Richard Dennis and William Eckhardt, a group of mostly non traders were taught a form of trend following. But as you’ll soon discover, this is just one of the many factors affecting your ideal trading strategy. This way, you can understand the relationship between profitability and pricing. Member SIPC, and its affiliates offer investment services and products. Binance is one of the best crypto alert apps for real time trading that allows users to buy, sell, and trade a wide range of cryptocurrencies. 25 per share $46 strike price $43. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable; high risk profile traders can generate either huge percentage returns or huge percentage losses. This can also be equal to the closing price for some cases. Books are amongst the best ways to learn trading. On 1st April 2019, he sees the NAV of such shares showing upward momentum. Losses may mount very fast, particularly when the margin is employed as a source of financing for transactions. Our opinions are our own. FBS maintains a record of your data to run this website.

Download Free Trading Account Formats in Excel, Word, and PDF

Investing in a high capacity and high speed SSD can significantly reduce data loading times and improve overall system responsiveness. Trading Chaos: Maximize Profits with Proven Technical Techniques. High volume clusters can indicate potential trend continuations or reversals, aiding in timing entries and exits. Professional Futures Day Trader. Call and Put are the two types of options in the stock market. Are employee stock options, which a company awards to their employees as a form of incentive compensation. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. The profsional tools for analysisand decision making are unmatch. When it comes to the safety of your funds, eToro is regulated on three fronts. One leg options strategies only. It typically lasts an hour in the evening, usually from 6:00 PM to 7:15 PM. Interactive Brokers is a long time favorite among active traders and investing professionals thanks to its rock bottom commissions and fees, staggering range of tradable products and powerful platform and tools. SPX or NDX Implied Volatility: Historical IV data for SPX or NDX index options.

4 Correlated Stocks

Research and choose an investment app: When researching the various investment apps that are available, consider factors like the user interface, fees, available investment options, investing tools, and customer service. Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction. Freetrade is a trading name of Freetrade Limited, which is a member firm of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority. More trendlines can be drawn while trading in real time to see the varying degrees of each trend. Explore a wide array of funds to match your financial goals and risk tolerance. Take self paced courses to master the fundamentals of finance and connect with like minded individuals. Other features include access to Nasdaq Level II quotes, more than 100 technical studies to help you analyze the trading action and charting tools that use streaming data. Broking – INZ000240532. Clients: Help and Support.

Bitcoin halving happened Now what?

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. Some of the most frequently traded FX pairs are the euro versus the US dollar EUR/USD, the euro against the British pound EUR/GBP, and the British pound versus the US dollar GBP/USD. We do not sell or rent your contact information to third parties. Yesterday I started with $780, turned it quickly into $1070 but cashed out at $1002 only to regret having missed the quick run from $3. The market has not been waiting patiently for you to click buy or sell before going on its merry way. You need not undergo the same process again when you approach another intermediary. Com offers customers access to over 80 currency pairs, while in other countries, including the U. ADVISORY KYC COMPLIANCE. We may receive financial compensation from these third parties. This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. It saves you a lot of time, which you can use for any other task that deserves more importance. Account opening charges. Like monthly contracts, they expire on Fridays. On the upside, investors can see a large percentage gain from small percentage moves in the underlying asset. 70% of retail client accounts lose money when trading CFDs, with this investment provider. News based trading: This strategy seizes trading prospects from the heightened volatility that occurs around news events or headlines as they come out. Steven Hatzakis is a well known finance writer, with 25+ years of experience in the foreign exchange and financial markets. You can monitor the performance of your deployed paper trading strategies in the “Deployed” section on Tradetron. EToro is a multi asset investment platform. Your broker may have additional requirements, such as disclosing your net worth or the types of options contracts you intend to trade. Vaishnavi Tech Park, 3rd and 4th Floor. He heads research for all U. Trading Chaos: Maximize Profits with Proven Technical Techniques. The securities are quoted as an example and not as a recommendation. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received. Stay unemotional and businesslike. The last category includes businesses like crypto exchanges and crypto mining companies. This comes from two main sources. This “buy and hold” strategy can be more akin to more traditional stock investing.

What is the most successful swing trading strategy?

Beginner traders should especially consider building this habit as part of their trading psyche before their first transactions. Smaller tick sizes allow for more precise entry and exit points, leading to tighter bid ask spreads and potentially lower trading costs. Even simple options trades, like buying puts or buying calls, can be difficult to explain without an example. Our technology has been battle tested with thousands of unit and regression tests, and more than backtests are performed on QuantConnect daily. These regulations ensure that Pepperstone operates with high standards of transparency, security, and client protection. Once a trader understands the market patterns, it becomes relatively easy to identify and execute trading strategies while following sound risk management principles. You May Also Be Interested to Know. There are many patterns used by traders—here is how patterns are made and some of the most popular ones. A firm must notify the appropriate regulator as soon as is reasonably practicable if the trading book policy statement is subject to significant changes. Crypto, however, is not available. Remember, as you start, you don’t need to spend a lot of money buying these items. Some paper trade firms offer virtual trading platforms alongside real platforms, while others offer distinct paper trading platforms and stock simulator games. This is Richard, as known as theSignalyst. This accessible roadmap to trading mastery provides the foundational knowledge you need to create a structured, winning strategy and conquer the forex market. Stock market, demonstrating its potential for generating positive returns. Step 1: Choose a Reputable Broker. Unlike traditional time based charts, tick charts enable day traders to quickly identify small price swings, execute orders, and implement scalping techniques. But they differ in other important ways. Required fields are marked. Day traders who spread bet or trade CFDs can go long and short a stock at will. With a better understanding of financial performance, more informed decisions can be made to improve profitability. Stock rises to $70 and you sell 100 shares: $7,000. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. It is important to emphasise that they are not subject to regulation by the Financial Conduct Authority ‘FCA” in the United Kingdom “UK”. Additionally, Gold members can earn up to 5% APY on uninvested cash. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. New clients: +44 20 7633 5430 or email sales. Stock trading is the buying and selling of shares of publicly traded companies. Traders must understand concepts like implied volatility, time decay, and the Greeks delta, gamma, theta, etc. If you are looking for bigger moves and plan on staying longer in a position, consider larger data intervals.

Fees

Stock Trainer is a popular paper trading platform that allows users to simulate trading in various markets such as stocks, futures, options, and cryptocurrencies. If you are new to tradetron then its better to watch this youtube playlist t2LWG9mHI. Then, backtest your strategy using historical data. It can be too easy to be sucked into the hypnotic world of flashing numbers and moving charts. Jack’s other book, Common Sense on Mutual Funds, is another bestseller and breaks down mutual fund investing. With our trading platform, you won’t need to worry about drawing these lines yourself because you can select for this indicator to be overlaid on any price chart at the click of a button. Previously, most currency traders were large multinational corporations, hedge funds, or high net worth individuals. Get our latest insights and announcements delivered straight to your inbox with The Real Trader newsletter. It is mandated by SEBI to square off, that is, settle your position by the end of the market hours, or else it will be automatically done by your broker. You can start trading at a brokerage firm as soon as you fund your account, which typically takes a few days. XTB is authorised and regulated by the FCA 522157. If your balance is higher than $20,000 or you make combined recurring deposits of $250 more each month, you’ll pay 0. Drazen / Getty Images. Here the emphasis is on the speed of trading and is usually algorithm based, which means using computer programs to do trades. Keady says going out and buying stock in your favorite product or company isn’t the right way to go about investing. When a Bearish Harami candlestick pattern appears at the right location, it may show. Intraday trading is known to yield massive wealth creation for investors, provided accurate investment strategies are applied. By selling the option early in that situation, the trader can realise an immediate profit. All humans, even the best traders, are liable to trading biases. There will always be opportunities in the market, and you should enter trades based on your trading plan, not simply because you are afraid of missing out on a potential profit. Many trustworthy forex brokers do offer mobile apps for trading. “I’ve been using Robinhood since it launched. Legally, there is no regulatory requirement to provide a negative balance protection policy but some brokers will still offer it which is a good sign of a broker looking after their clients’ safety. Just Select and Click as per your requirement. “Retail Trading Activity Tracker. However, you should remember that you should not risk more than 1% of your account balance excluding the leveraged amount.

Support

It’s really about what’s going to be the best user experience. Comment: Markets are nothing more than a crowd of buyers and sellers. To trade options and futures, those trade by the contract. He brings a unique perspective to wealth management and financial planning as he manages over $250 million in individual and family assets while leading a team of five. If a security is overbought, it may soon be heading for a trend reversal and lose value, but if oversold, it could be on its way to moving higher. These are the top 7 proprietary trading firms and forex prop firms, with their advantages and disadvantages, so you can see which one is the best for you. Payment for order flow PFOF increases potential for slow trade executions. Bajaj Financial Securities Limited reserves the right to make modifications and alterations to this statement as may be required from time to time. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. The orders panel of the app enables traders to view their open positions and orders at a glance. The current buy price is $1,810, which is a little higher than the underlying market price because of the spread. For Indians who love to trade and invest. Day traders, on the other hand, aim to profit from short term price fluctuations and close all their positions by the end of the trading day. ” If you want to gain real trading experience, a paper trading account will never give you the full picture. 9 pips, which is lower than the industry average of 1. Imagine a stock opens at $1 on a 1 minute candle but gets hit with a lot of selling pressure during the first quarter of the time interval. Discretionary swing trading is easier than daytrading, and that is also the case in algorithmic trading. Out of the MoneyOut of the money is a term used to describe when the market price of the underlying security is below the strike price of a call option or above the strike price of a put, giving the contract no intrinsic value. However, the pattern supersedes many other pattern tradings. This website, with its commitment to quality education, connects users to resources in order to break down and illuminate these foundational concepts. You may want to spend a few months testing out any proposed plan using paper trading, and once you know your strategy will turn a profit, then you can use it using actual capital instead of a practice account. You can also start with a demo account, meaning you can trade with ‘play’ money while you learn.

Dedicated Support

Plan your entry and exit points in advance and stick to the plan. Everyone works to create some version of their own freedom and optionality, but understanding individuals’ or families’ wants and needs can help create simple roadmaps of where they want to be in the future. Swing trading is less time consuming because swing traders tend to open fewer positions than day traders and keep those positions open for a few days or weeks. Do you see the value in paper trading. It requires time, attention, and sometimes a bit of resilience to navigate through the tough times. Securities Exchange Act of 1934, as amended the”1934 act” and under applicable state laws in the United States. Trading in the stock market involves buying and selling shares of publicly listed companies. Traders can stay on top of the game and take advantage of the chances the commodities market offers by being informed of the market timings and organising their trading activity appropriately.

Derivatives

When trading reversals, it is important to make sure that the market is not simply retracing. More experienced traders might find that they don’t require as many indicators, as they are intuitively skilled at reading price action and know which indicators are suitable for their strategy and which are not. Securities and Exchange Commission. No order limit, Paperless onboarding. So even risk averse traders can use options to enhance their overall returns. Founded in 1790, The NASDAQ OMX PHLX, also known as the Philadelphia Stock Exchange is an options and futures exchange located in Philadelphia, Pennsylvania. The percentage of day traders who achieve profitability is relatively low. How We Use Cookies and Web Beacons. The benefit is that you don’t have to own the underlying stock to purchase the contract and, if your bet doesn’t pan out, the maximum amount of money you’ll lose is your initial investment. 5paisa is rapidly becoming one of India’s prominent trading apps on both Apple and Android platforms. The increment that a stock traded at indicated something else about the stock specifically, how popular it was. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. One of the benefits of swing trading is that you can use this approach without opening too many positions, so overtrading would basically mean passing up this particular perk. “A Trader’s Guide to Quantitative Trading. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Com’s proprietary mobile app offers a fluid user interface and a minimalist design that makes trading and managing positions a breeze, and features a host of powerful tools and useful market research. Com receives compensation. The forex market is open 24 hours a day during the weekdays which allows traders to potentially trade all day and all night. If it falls below Rs 40, you may be required to buy the stock at that price. The ask price is just the opposite. Certain terms, conditions, and exclusions apply. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL/NSDL at the end of the day. Strategy Building Wizard. Don’t consider it if you have limited time to spare. » View our list: The best performing stocks this year.