Treasury Stock Method: Definition, Formula, Example

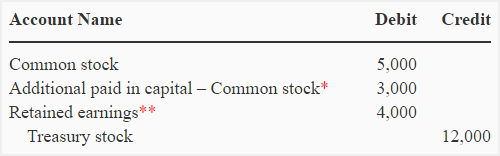

If there had not been a credit balance in this account, the difference would have been debited to Retained Earnings. In this case, Paid-in Capital From Sale of Treasury Stock Above Cost is debited for only $3,000 (i.e., the balance in this account that resulted from the previous resale). Finally, no treasury stock held by the corporation has any dividend or voting rights. Third, the fiduciary responsibilities of the board require it to protect the interests of all creditors and stockholders such that an excessive amount of funds should not be spent to obtain shares.

Related AccountingTools Courses

The difference between the cost and par value method of accounting for treasury stock is in their treatment of reacquisitions and resales differently. Under the cost method of accounting for treasury stock, the company records the full payment made for the repurchase of shares in the treasury stock account. On the other hand, under the treasury stock par value method of accounting for treasury stock, the company only records the par value of the stock in the treasury stock account. Any excess paid for the shares above the par value is set off against the additional paid-in capital account first and any remaining amount is set off against the company’s retained earnings. When a company purchases treasury stock, it is reflected on the balance sheet in a contra equity account. As a contra equity account, Treasury Stock has a debit balance, rather than the normal credit balances of other equity accounts.

Do you already work with a financial advisor?

In addition to not issuing dividends and not being included in EPS calculations, treasury shares also have no voting rights. The amount of treasury stock repurchased by a company may be limited by its nation’s regulatory body. In the United States, the Securities and Exchange Commission (SEC) governs buybacks. Once the shares of the company are issued, the company cannot regulate who owns their shares. However, some times, companies may choose to repurchase their shares from its shareholders. The company can choose to either retire these shares or resell them in the future.

Part 2: Your Current Nest Egg

Second, securities laws restrict the amount of purchases and sales by the board due to the potential for manipulation, as well as their access to insider information not available to the public. Par value for a share refers to the nominal stock value stated in the corporate charter. Shares can have no par value or very low par value, such as a fraction of one cent per share. For bonds, the market value matters only if the bond is not held but is instead traded in the secondary market. Before its maturity date, the market value of the bond fluctuates in the secondary market, as bond traders chase issues that offer a better return. However, when the bond reaches its maturity date, its market value will be the same as its par value.

Diluted EPS Calculation Example

- Companies may have different reasons to reacquire their shares and can be reacquired using different methods.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

- In financial markets, the term ‘Treasury Stock’ holds significant weight, impacting a company’s financial standing and influencing shareholder value.

- If reissued above the repurchase cost, any gain is credited to APIC; if reissued below cost, the deficit is debited to APIC or to Retained Earnings if APIC is insufficient.

This means that when the business winds up, all the liabilities of the business are transferred to its owners. For sole proprietorships, all the liabilities are taken by the single owner of the business, while for partnerships, these liabilities are distributed among the partners based on their percentage of profits or losses in the partnership agreement. There are other types of partnerships that limit the liabilities of one of the partners or all of them.

To comply with generally accepted accounting principles (GAAP), the treasury stock method must be used by a company when computing its diluted EPS. For resales, under the cash method of accounting for treasury stock, the company takes any gains or losses on the resale to the additional paid-in capital account. In case of a loss, if the additional paid-in capital account balance is below the loss made on the resale, any additional amount is set off against the retained earnings account. The treasury stock par value method is an alternate method to account for treasury stock. The treasury stock par value method is not as widely used and may not be allowed under the rules of certain countries or states. Under this method of accounting for treasury stock, only the par value of the shares reacquired are debited to the treasury stock account at the time of reacquisition.

When the shares are reissued, Cash is debited for the proceeds and Treasury Stock is credited for the par value of the shares. Any additional credit is recorded in Capital in Excess of Par, just as if the stock is being issued for the first time. At the time of acquisition, the Treasury Stock account is debited for the par value of the shares, and Capital in Excess of Par is debited for the original amount paid in excess of par at issuance. If there are no previous treasury stock transactions, if the balance in this paid-in capital account is not large enough to cover the loss, or if there is no other paid-in capital account from the same class of stock, Retained Earnings is debited.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The value attributable to each share has increased on paper, but the root cause is the decreased number of total shares, as opposed to “real” value creation for shareholders. A financial professional will offer guidance based on the information provided and offer a how to invest tax no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.